Property Tax Frequently Asked Questions

Looking for more information on City of Nanaimo property taxes? Below you will find answers to some frequently asked questions about property taxes.

Property Tax FAQs

-

Property Assessments

HOW DOES YOUR PROPERTY ASSESSMENT IMPACT YOUR PROPERTY TAXES?

Some confusion surrounds property assessments and their connection to property taxes so let’s clear that up.

My BC Assessment doubled, does this mean my property taxes will too?

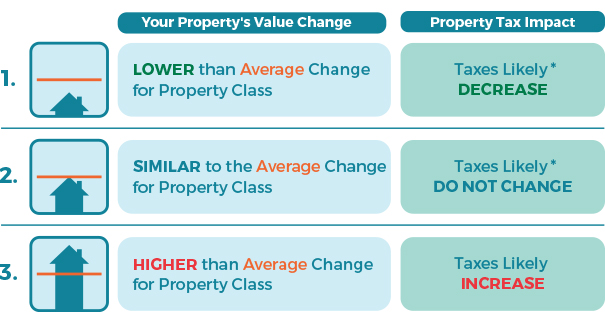

Not necessarily. If your property assessment is in line with the average assessment increase in Nanaimo, your City of Nanaimo property tax increase will equal the approximate increase approved by Council for this year. If your assessment is lower than average, your property tax increase will be lower. If your assessment is higher than average, your property tax increase will be higher.

So, it’s not how much your assessed value has change, but how it has changed compared to the average change in your property class. The image below from BC Assessment's website illustrates what was explained above.

If the assessed values are higher does that mean the City gets more money?

No, we’re not here to make a profit; we’re here to deliver municipal services. The budgeting process for the City is extensive, taking many months each year. To put it simply, we calculate how much it will cost to “run” the City (deliver services, maintain infrastructure, deliver projects, contribute to infrastructure renewal reserves, etc.) in a given year and then determine how we are going to pay for that. Tax rates are then calculated to collect only the revenue required from the assessed base.

I want to appeal my BC Assessment, where do I do that?

If you have received an assessment that you don’t agree with, you can appeal it through the BC Assessment Authority. You can find contact information and more on your assessment notice and find information on appealing on the BC Assessment website. The deadline to appeal is January 31.

I have my 2023 BC Assessment figures, why can’t the City tell me what my tax bill is going to be for 2023?

Although the City of Nanaimo has determined what the approximate property tax increase will be for 2023, there could be changes to the approved Financial Plan before the tax rate bylaws are set, which happens each year before May 15. In addition, the City collects taxes for other entities (Regional District of Nanaimo, School District 68, the Vancouver Island Regional Library, the Municipal Finance Authority and BC Assessment) that have different deadlines and may not have completed the budget and tax requisition processes. For example, the Regional District of Nanaimo has until April 10 to provide the City with tax requisition information.

-

Your Property Tax Notice

HOW DO YOUR PROPERTY TAXES MAKE A DIFFERENCE TO YOUR COMMUNITY?

Each property tax bill helps pay for the important City services and initiatives that make Nanaimo a community that is livable, environmentally sustainable and full of opportunity for all generations and walks of life. There are two components to the annual property tax increase – a general increase for City operations and a one per cent increase of the annual contribution to the general asset management reserve.

How are my taxes calculated?

The City of Nanaimo determines the tax rate based on what we need to balance the budget for the year. Your tax bill is calculated based on your property’s assessed value, which is determined by BC Assessment and then by the tax rate.

The City also collects taxes for other agencies that offer services in the City including:

- School District

- BC Assessment

- Municipal Finance Authority

- Regional District of Nanaimo (RDN)

- Vancouver Island Regional Library

- Parcel tax for RDN

These agencies determine a tax rate needed for their operations in a similar fashion as the City.

Example:

Your property is assessed by BC Assessment at $350,000 (the City of Nanaimo does not assess property values).

City Council determines the residential tax rate needed. For 2022 this rate was 6.0087 for every $1,000 assessed value.

Therefore $350,000/$1,000 x 6.0087 = $2,103.05 in Municipal taxes.

Did you know?

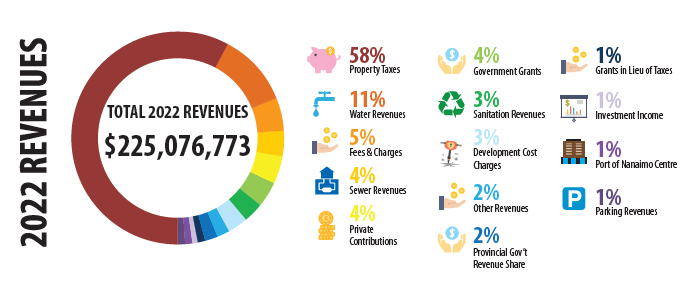

There are many revenue sources we use to cover the annual budget and one source is property taxes. Of all the sources of revenue the City collects, property taxes make up for about 58% of revenue in the 2022 Provisional Budget. See the graphic below for a breakdown of revenue sources.

I received a tax notice for a property that I no longer own, what should I do?

If you have the information of the new owner, you should forward the information to them.

My spouse/relative passed away. How do I get the name on the tax notice changed?

Any changes to the ownership of a property, including name changes, should be filed at the:

Victoria Land Title Office

Suite 200 -1321 Blanshard Street

Victoria, BC V8W 9J3

Phone:1-877-577-LTSA (5872) or 604-660-0380I think that my taxes are too high, can I appeal them?

Each May tax rates are set by Council and all residential properties are taxed at the same rate. As mentioned above, if you wish to appeal your assessment, please contact BC Assessment.

How do I decide where my principal residence is?

A principal residence is the place that a person makes their home and conducts their daily affairs.

What is the tax year?

The tax year runs for the calendar year, January to December.

-

Paying Property Taxes

HOW ARE MY TAX DOLLARS USED?

The taxes you pay to the City of Nanaimo go toward the municipal services, projects and programs such as paved roads, recreation centres, parks, police and fire services and more. The City also puts money aside each year for the general asset management fund.

What ways can I pay my property taxes?

There are a number of ways you can pay:

- Your bank: online, phone or in person. When paying this way for this first time, search “Nanaimo”. The folio number on your tax notice is the account number.

- Mail a cheque: 455 Wallace Street, Nanaimo, BC, V9R 5J6. Payment must be received by July 4, 2023.

- At the Service and Resource Centre: 411 Dunsmuir Street, Monday through Friday from 8 am to 4:30 pm.

- Your mortgage company: Make sure their name is listed on the front of your tax notice. Don’t forget to apply for the Home Owner Grant.

- Pre-authorized payments: Visit www.nanaimo.ca/goto/paws for more information or give us a call at 250-755-4415.

Late payment penalties will be applied to payments made after July 4, 2023.

Did you know?

You can manage all your City of Nanaimo bills in one convenient place. With MyCity, your user rates and property tax bills can all be viewed and managed online. Visit mycity.nanaimo.ca to log in. Don’t have an account yet? Learn how you can set up your MyCity account at: www.nanaimo.ca/goto/MyCity

I pay my taxes through the installment plan. Do I need to do anything else?

You need to claim your Home Owner Grant (if eligible) with the Province of BC and pay any amount outstanding shown on your Property Tax Notice. Any outstanding balance after the first business day in July will be subject to a penalty.

Can I defer my property taxes?

If you are over the age of 55, widowed, a person with disabilities or a family with children, you may qualify for property tax payment deferment. This Provincial program provides low-interest loans to qualified homeowners to pay their primary residence property taxes. Find more information and links to the online application system at: www.nanaimo.ca/goto/TaxDeferment.

-

Home Owner Grant

HOW CAN I REDUCE MY TAX BILL?

The Home Owner Grant is a great way to reduce the amount of your property tax bill. Under this Provincial program, eligible home owners under the age of 65 can reduce their taxes by up to $770 and up to $1,045 for seniors. If you are eligible for a grant, your taxes will be reduced by the amount of the grant claimed; rebates are not issued.

How do I apply for the grant?

Apply for your Home Owner Grant online through the Province with a new online system that's easy to use and processes applications faster. Visit http://www.gov.bc.ca/homeownergrant or call or phone 1-888-355-2700 for more information. In order to avoid penalties and interest, apply before the tax due date. Municipalities no longer accept Home Owner Grant applications.

I have applied for my grant. When will I receive my rebate?

Rebates are not issued. Your taxes are reduced by the amount of the grant claimed.

I didn’t claim my Home Owner Grant last year. Can I still claim it?

The Provincial Government allows an extension of time in which you can claim a grant for the prior year if you meet certain qualifications. This is called a retroactive Home Owner Grant and can be claimed directly with the Province. Visit http://www.gov.bc.ca/homeownergrant for more information.

Why am I being penalized for not claiming my Home Owner Grant?

The amount of taxes owing is reduced by claiming the grant you are eligible for. Until you claim your grant the total remains outstanding. Grants have to be claimed each year that you are eligible.

If I am selling my home, who should apply for Home Owner Grant and pay the taxes?

The legal owner of the property should pay the taxes and claim the grant.

Property taxes are usually taken into consideration by legal representatives in a property sale transaction and are included on the Statement of Adjustments. If you cannot see an adjustment for property taxes on your Statement of Adjustments, contact the lawyer who drafted the document.

The property taxes were paid by the lawyer, what should I do?

Ask your lawyer if you are responsible for claiming the Home Owner Grant.

-

Deferring Property Taxes

ARE THERE OPTIONS TO DEFER MY TAXES?

If you are eligible, you can defer your property taxes. This provincial program provides low-interest loans to qualified homeowners to pay their property taxes.

Do I qualify for tax deferment?

There are two options which you may qualify:

- Regular program: you are 55 or older, widowed or a person with disabilities.

- Families with Children Program: you are a parent, stepparent or financially supporting a child.

In order to defer, any overdue property taxes from previous years, outstanding penalties and interest charges much be paid.

How does it work?

If your application is approved, the Province of BC will pay your property taxes on your behalf. Interest is charged on tax deferment loans at 1.2% for the Regular Program and 3.2% for the Families with Children Program.

Deferred taxes and interest are paid when your home is sold or transferred. Eligible homeowners may also use some of the appreciation in the value of their home to pay their property taxes at a later date. Deferment is only available on primary residences; cottages and rental properties do not qualify.

When residents qualify to defer their property taxes does this mean other residents pay more?

Deferring property taxes does not impact the City’s tax base or the amount of property tax revenue the City receives. If a resident's application to defer their property taxes is approved, the Province of BC will pay the City their portion of property taxes on their behalf. The resident pays interest on the tax deferment loans, and deferred taxes and interest are paid when their home is sold or transferred.

How do I apply?

To apply you will need your annual property tax notice, Social Insurance Number, date of birth and any supporting documentation if necessary.

The Province has created an online system for processing new deferment applications and renewals. This means City no longer accepts deferment applications.

Find more information, visit the Property Tax Deferment page.

Last updated: November 13, 2024

Help us improve our website

Collection and use of your personal information

Information collected on this form is done so under the general authority of the Community Charter and

Freedom of Information and Protection of Privacy Act (FOIPPA), and is protected in accordance with FOIPPA. Questions about the collection of your personal information may be referred to the Legislative Services Department at 250-755-4405, or via email at foi@nanaimo.ca. Please also see our Privacy Policy.

-

Parks, Rec & Culture

- Recreation Facilities & Schedules

- Parks & Trails

- Activity Guide

- Events

- Register for a Program

- Drop-In Schedules

- Public Art

- Culture

- Poetry

-

City Services

- Garbage & Recycling

- Home & Property

- Water & Sewage

- Online Services

- Cemetery Services

- City Services Directory

-

Property & Development

- Urban Forestry

-

Building Permits

- Online Building Permit Application

- Building Permit Revision

-

Application for a Residential Building Permit

- Access (driveway) Permit

- Accessory Building Permit

- Alteration Permit

- Building Envelope Repair

- Carriage House

- Demolition Permit

- Fence or Retaining Wall Permit

- Geotechnical Reports

- Locate Permit

- New Construction Permit

- Plumbing or Services Permit

- Secondary Suite Permit

- Special Inspection Permit

- Swimming Pool Permit

- Woodstove Installation Info

- Green Home Initiatives

-

Apply for a Commercial Building Permit

- Access (driveway) Permit

- Commercial Alteration Permit

- Building Envelope Repair Permit

- Demolition Permit

- Fence or Retaining Wall Permit

- Geotechnical Reports

- Leasehold Improvement

- Locate Permit

- New Commercial Construction Permit

- Occupant Load Permit

- Signs Permit

- Special Inspection Permit

- Sprinkler Requirements

- Fees and Bonding

- Commercial Plumbing Permit

- Certified Professional Program

- Bylaws for Building

- Forms and Guidelines

- Book a Building Inspection

- Report Illegal Construction

- Request Building Plans

- Building Permit Statistics

- Permit Fee Calculator

- Building News and Alerts

- Fast Track Building Permits

- Development Applications

- What's Building in my Neighbourhood

- Development Activity Map

- Community Planning

- NanaimoMap

- Rebates

- Engineering Survey

- Land Use Bylaws

- Soil Removal and Depositing

- Heritage Buildings

- Sustainability

- Transportation & Mobility

-

Your Government

- Get Involved

- Government Services Guide

- News & Events

-

City Council

- Advocacy

- Contact Mayor & Council

- Council Meetings

-

Boards & Committees

- Advisory Committee on Accessibility and Inclusiveness

- Board of Variance

- Design Advisory Panel

- Finance and Audit Committee

- Governance and Priorities Committee

- Mayor's Leaders' Table

- Nanaimo Performing Arts Guild

- Parcel Tax Roll Review Panel

- Special District 68 Sports Field and Recreation Committee

- Public Safety Committee

- Understanding Council Committee Structures

- Council Policies

- Mayor's Office

- Council Initiatives

- Proclamations

- Bastion Lighting Requests

- Alternative Approval Process

- Budget & Finance

- Records, Information & Privacy

- Elections

- Contacts

- Careers

- Maps & Data

- Projects

- Tourism Nanaimo

- Grants

- Awards

- Accessibility & Inclusion

-

Doing Business

- Economic Development

- Doing Business with the City

- Business Licences

- Filming in Nanaimo

- City Owned Property

- Encroachments onto City Property

- Liquor Licences

- Cannabis Retail

- Business Improvement Areas

- Procurement Services

- About Nanaimo

- Green Initiatives

-

Public Safety

- Public Safety Contacts

- Nanaimo Fire Rescue

- Emergency Management

- Police & Crime Prevention

- City Bylaws

- Community Safety and Wellbeing

- Emergency Services